{4 minutes to read} Today, I want to talk about a concept called Return of Premium. Return of premium life insurance has been around for some time now and mostly has been talked about in the context of what we call Return of Premium Term Life Insurance. So, let’s say at the end of the 10- or 20-year term, you have a chance to recapture the premiums that were paid.

This became somewhat of a popular product but the problem I have with Return of Premium Term is if you elect to take your premiums back, you no longer have the life insurance, and that life insurance may become more and more important as your health may have changed and you’ve become uninsurable and at the end of the term policy, it’s going to expire anyway. So, with the new changes to life insurance products that happened at the end of last year, cash values on permanent policies, whole life policies have been greatly enhanced to the point where we can develop what I call Return of Premium Whole Life — not your father’s return of premium.

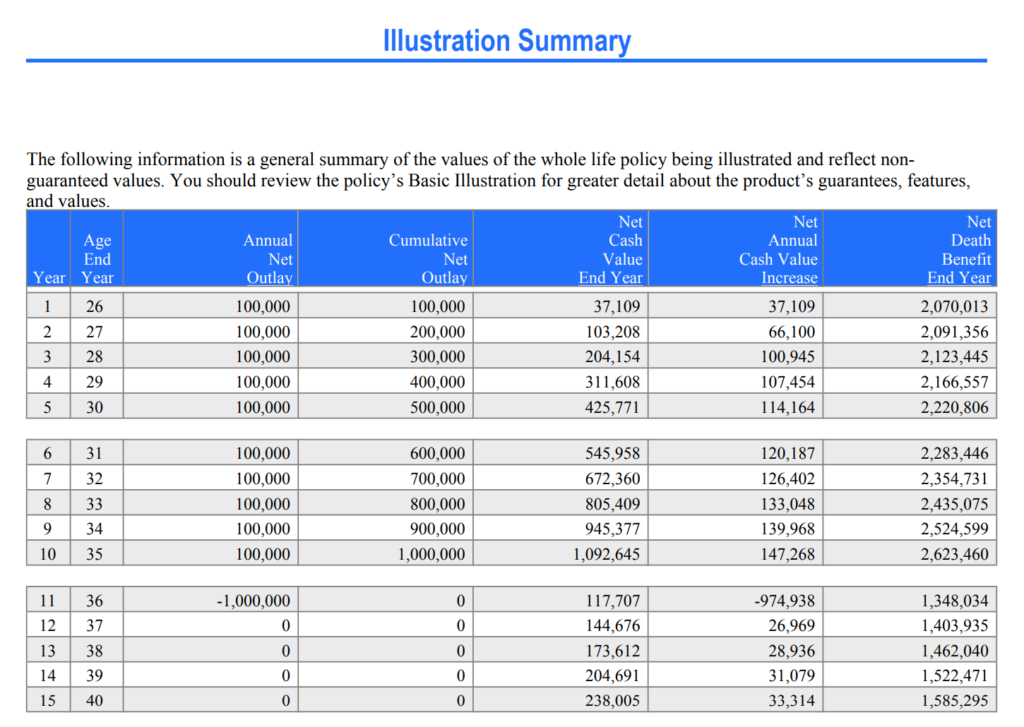

Because this type of return of premium, as you can see from the illustration, is the type of policy where you can take back all the money that you paid into the policy, but still keep the life insurance. And not only can you still keep the life insurance, you still have quite a bit of cash value. And if there was long-term care on the policy, you would still have the long-term care portion.

So, in the illustration that I have attached to this, you can see that there’s a policy where the client makes 10 payments of $100,000, and after the 10 payments are over, he or she withdraws that $1 million via a withdrawal and a policy loan. So, all the money that was paid in is taken back out. And even after the withdrawal of the million dollars, returning all the premium back into the client’s pocket, the insurance death benefit and cash value are still in the policy. This is based upon the guaranteed cash values and the dividends which are not guaranteed. However, the Guaranteed Cash Value is $873,167 in year 11 when we return the premiums.

This was for a 26-year-old, and initially, the death benefit was $2 million. At age 65, the client would have $2.3 million of net cash value (including Non-Guaranteed Dividends) and $4 million in death benefit, at a net cost of zero. Pretty impressive numbers.

Take a look at the illustration below. MassMutual can do this with a 10-pay policy as I’ve illustrated for you. We also have a 15-pay, a 20-pay, life paid up at 65 and life paid up at 85 — all products that work very well with this return of premium concept.

Return of Premium 10-Pay Policy While Keeping the Policy

If you’d like to learn more, give us a call at (631) 806-3568, or send us an email at michael@swanwealth.com.

Have a happy and healthy New Year.

Registered Representative offering Securities through American Portfolios Financial Services, Inc. (APFS) Member FINRA/SIPC. Investment Advisory Services are offered through G&G Planning Concepts, Inc. which is not affiliated with APFS. Strategic Wealth Advisors Network and Gassman Financial Group are not affiliated with APFS.

Any opinions expressed in this forum are not the opinion or view of American Portfolios Financial Services, Inc. (APFS) or American Portfolios Advisors, Inc.(APA) and have not been reviewed by the firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.

This material is for informational purposes only. Neither APFS nor its Representatives provide tax, legal or accounting advice. Please consult your own tax, legal or accounting professional before making any decisions.American Portfolios Financial Services, Inc.(APFS) and American Portfolios Advisors, Inc.(APA) are not affiliated with any other named business entities mentioned.

Michael Fliegelman, CLU, ChFC, AEP, CLTC, RFC

Founder / President, Strategic Wealth Advisors Network

(631) 262-9254

Connect with me ![]()

![]()

Follow me on ![]()

![]()

![]()

Michael@SWANWealth.com

www.SWANWealth.com

Please note that the information being provided is strictly as a courtesy. Always confer with your CPA prior to attempting to take any tax deduction. Michael Fliegelman is not a CPA, nor should the contained be considered tax “advice”.

Leave A Comment