{5 minutes to read} Today, we’re going to talk about estate planning for families that have special needs children—whether adult or minor children—and what the estate plan needs to consider for these persons with special needs.

Normally, with two children, an estate is equally left to both. However, when there is a child with special needs, that plan would cause tremendous problems, because there are government benefits that are only provided to a special needs child if they can’t afford to pay for those benefits out of their own pocket. So, if we were to equally divide, let’s say, our $2 million estates between our two kids, we would unintentionally disqualify the child with special needs for the government benefits that they could receive.

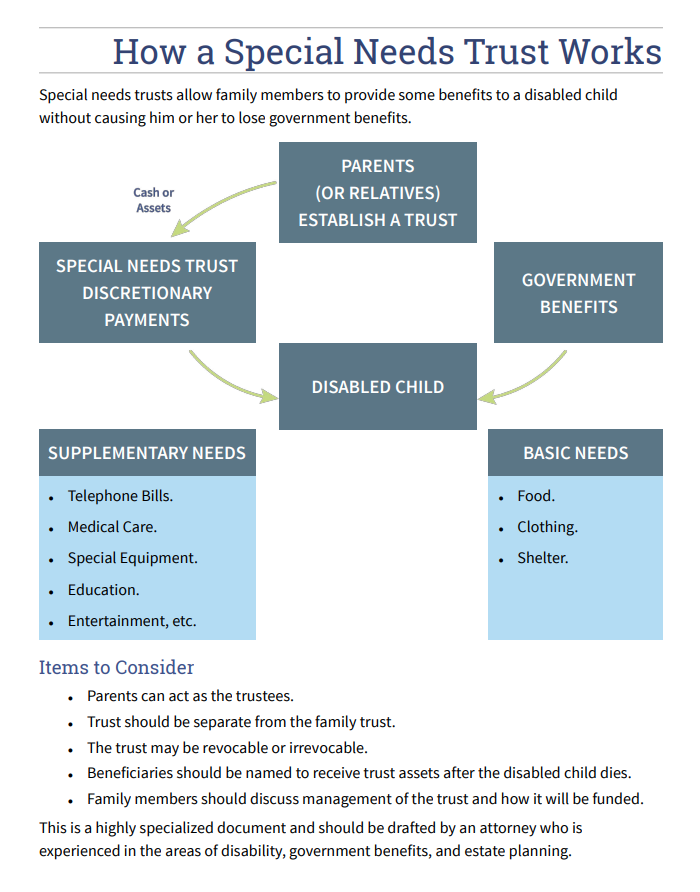

Instead of leaving the disabled child half the inheritance, it would be better to set up a Special Needs Trust. The reason it’s called a Special Needs Trust is that it will only provide income to the child and/or the trustee for the benefit of the child, for those things that the government benefits will not provide. By setting up the inheritance through a Special Needs Trust, we would not be throwing away what could be a tremendous benefit, which is vitally important for anybody that has children with special needs.

These Special Needs Trusts can be one of two types. One is what we call a Living Trust. The other one is called a Testamentary Trust. We’ll go over both briefly.

With a Special Needs Living Trust, we recommend that the trust be established and funded with life insurance. This means that we do not have to disinherit the non-disabled child of any of the family’s assets to fund the trust. And we can create a pool of money, whether that would be half a million, $1 million, or even $2 million, for the disabled child through the Special Needs Trust. By using life insurance, we can create that pool of money by simply paying the premium due for the policy purchased. This allows the parents of the child to know that this pool of money will be guaranteed to be created at the death of the insured.

With a Special Needs Trust, the family can rest assured knowing that if something were to happen to the husband and the wife, there would be a guaranteed death benefit payable tax-free to the Special Needs Trust that could act as a cushion for the disabled child while still allowing them to have access to government benefits. This additional money would only be allocated for those special needs that are outlined in the Special Needs Trust.

This is a very simple and beneficial arrangement because traditional estate planning says that I’m going to make sure my kids are okay throughout my lifetime. But if I am the parent of a child with special needs, I would want to make sure that they’re taken care of even after I am gone. That’s why insurance plays such a vital role because as long as the payments are made into a good guaranteed permanent policy, that amount of money will be paid tax-free to the Special Needs Trust.

Alternatively, we could set up a Testamentary Trust. This type of trust is not set up now but is set up as a provision in your will. This provision can allocate a specific amount of dollars or a percentage of the estate that will get paid into the Special Needs Trust at my death or my wife’s death, or the death of the second of the two of us to die. By doing it this way, I can use all my assets and put a specific amount into the Special Needs Trust, or I could buy a life insurance policy that could be utilized to increase the size of the estate, and then allocate a percentage of that money into the Special Needs Trust.

So, whether it’s a Testamentary Special Needs Trust at death or a Living Trust we set up today, these two concepts can be helpful for families with special needs children.

If you would like to learn more or get educated on this, let us know. I’ve attached a link to a brief article that explains this in more detail, and we certainly would be happy to set up a call or a meeting to discuss how a Special Needs Trust can be used to make sure your estate plan is set up properly for your specific family’s needs.

How a Special Needs Trust Works

Thank you so much. Stay safe and stay healthy.

Thank you so much. Stay safe and stay healthy.

Registered Representative offering Securities through American Portfolios Financial Services, Inc. (APFS) Member FINRA/SIPC. Investment Advisory Services are offered through G&G Planning Concepts, Inc. which is not affiliated with APFS. Strategic Wealth Advisors Network and Gassman Financial Group are not affiliated with APFS.

Any opinions expressed in this forum are not the opinion or view of American Portfolios Financial Services, Inc. (APFS) or American Portfolios Advisors, Inc.(APA) and have not been reviewed by the firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.

This material is for informational purposes only. Neither APFS nor its Representatives provide tax, legal or accounting advice. Please consult your own tax, legal or accounting professional before making any decisions.American Portfolios Financial Services, Inc.(APFS) and American Portfolios Advisors, Inc.(APA) are not affiliated with any other named business entities mentioned.

Michael Fliegelman, CLU, ChFC, AEP, CLTC, RFC

Founder / President, Strategic Wealth Advisors Network

(631) 262-9254

Connect with me ![]()

![]()

Follow me on ![]()

![]()

![]()

Michael@SWANWealth.com

www.SWANWealth.com

Please note that the information being provided is strictly as a courtesy. Always confer with your CPA prior to attempting to take any tax deduction. Michael Fliegelman is not a CPA, nor should the contained be considered tax “advice”.

Leave A Comment