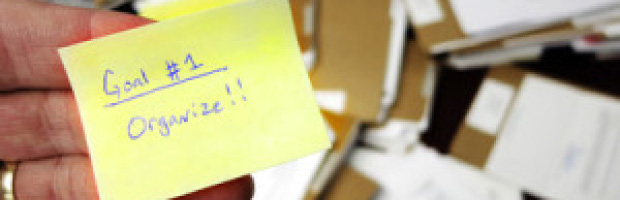

Have you looked at your Financial Junk Drawer Lately?

When we sit with clients initially, we find that most people have what we call the financial “junk drawer.” What does that mean? It means they don’t have an organized approach to making money decisions. Their decisions are made throughout their lives, at different times, with different objectives, sometimes with different advisors, and all coming from different places and biases. What they usually ends up with a feeling of disorganization, a lack of a cohesive overall strategy, and a feeling that things are out of control or unmanageable.

Everyone accumulates products and assets over time, such as:

- an IRA

- an investment account

- bank accounts

- insurance policies

- retirement plans

- employee benefits

- real estate

The list can go on and on.

You have all of these things, but just like when you go into your kitchen and open up that junk drawer looking for a particular item, you sometimes you can’t find it. You have staples, rubber bands, pens, extra keys, glue, the take out menu for the Chinese restaurant, the instructions for the juicer all thrown in the drawer and not organized or easily accessible.

What we do is empty out the financial “drawer” and place all the financial decisions, products, amount of dollars, premiums, contributions and savings into a financial model that gives you the opportunity to see your entire financial picture on one piece of paper. By doing this, we establish a baseline of your current personal economic picture and begin to see that picture from a macro economic point of view.

For example, maybe you don’t have a will. The model will highlight that. Maybe you’re not saving enough money. The model will highlight that. Or you have products in there but they are not the right products because the financial environment has changed; the laws have changed. Now:

- You need a new will.

- You need a different type of investment.

- You need a different type of insurance product

Gathering all the asset information and financial documents that make up your financial picture is the critical first step but also the hardest part for many. Once organized and gathered, we can begin the process of assessment, analysis, and improvement that will move you from where you are to where you want to be.

So, let us help you organize your junk drawer into a planned model and create the personal economic picture that is best for you.

Michael Fliegelman, CLU, ChFC, AEP, CLTC, RFC

Founder / President, Strategic Wealth Advisors Network

(631) 262-9254

Connect with me ![]()

![]()

Follow me on ![]()

![]()

![]()

Michael@SWANWealth.com

www.SWANWealth.com

Please note that the information being provided is strictly as a courtesy. Always confer with your CPA prior to attempting to take any tax deduction. Michael Fliegelman is not a CPA, nor should the contained be considered tax “advice”.

Leave A Comment