Retirement planning for people over the last 5-6 years has become a little more challenging than it used to be. People are now more cautious with their money, and their focus on generating guaranteed income for life is becoming a greater necessity. In the past, people who accumulated $1 million for retirement felt that they could pull $50,000 to $70,000 a year out of their portfolio, because their expectation was that the market would create rates of return that would allow for that type of distribution.

Unfortunately, those who retired around 2007-2009 experienced a down market which, in combination with those withdrawals, had a potentially devastating impact on their net worth and their ability to sustain that retirement income. Given those circumstances, what I want to talk about are some concepts that are somewhat out-of-the box and challenging to understand but can generate guaranteed income for life no matter what the market does.

A couple of months ago I was watching one of my favorite TV shows, “Boardwalk Empire”, and Nucky Thompson gave to this lady with whom he had an affair, a contract that said “a guaranteed income for life.” He was looking to part ways with this woman, but he wanted to do something to set her up for life, so he gave her this annuity contract, a guaranteed income for life. Wow, what a great gift to give someone.

Today, more and more, we believe people need to consider these types of products. These fixed guaranteed lifetime annuities allow people to know that no matter how long they live, they will have that guaranteed income for life. The annuity concept has met with a tremendous amount of resistance by consumers. The reason for that is that people don’t like to lose control. In essence, when they buy one of these income annuities, they are trading their capital for the guarantee of income for life, so even though they have a guaranteed income, they lose control over their capital. Therefore, annuities are not for everyone.

A conservative investor, let’s say a 65-70 year old woman, who invests $1 million in guaranteed savings, a very conservative investment, won’t be able to generate, based upon today’s low interest rates, a whole lot of income from that money. Without taking a risk with that portfolio, she may get $10,000 – $30,000 at most. Withdrawals in excess of that could, in essence, cause the principal to deteriorate or be gone. As an alternative, utilizing an income annuity, she might be able to generate $60,000 – $75,000 a year, guaranteed for life.

So why would the consumer hesitate? Well, first if they die right away, that $1 million is gone, but there are however, a couple of options that we try to bring to our clients that help them get the income they want without losing control over the principal.

- A permanent life insurance policy in force prior to retirement could replace the lost money from the annuity.

- Choose an annuity that has a guaranteed refund feature, meaning that if you had $1 million invested and the first year’s income was $70,000 and then you died, the annuity would refund the remaining $930,000 to the estate or to the beneficiaries.

- The annuity can be set up where it would guarantee payments until at least the $1 million is received. This is known as “installment refund annuity.”

Especially for healthy people, longevity is a big issue. My wife’s grandmother lived to 103 years old, so somebody who is looking to retire at 65 or 70 might be looking at a 30 or 40 year period in which they need to generate income. Despite the fact that people are living longer and longer, the annuity guarantees that no matter how long you live, the income will continue.

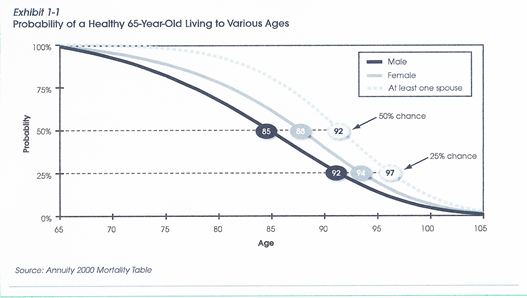

The Chart below, Exhibit 1-1, shows the probability of a healthy 65 year old living to various ages. This longevity risk is significant and is compounded by potentially increased costs for healthcare in later stages of life. Therefore, having a long term care policy is part of a well planned retirement.

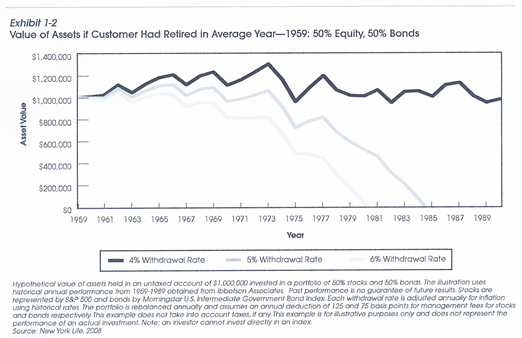

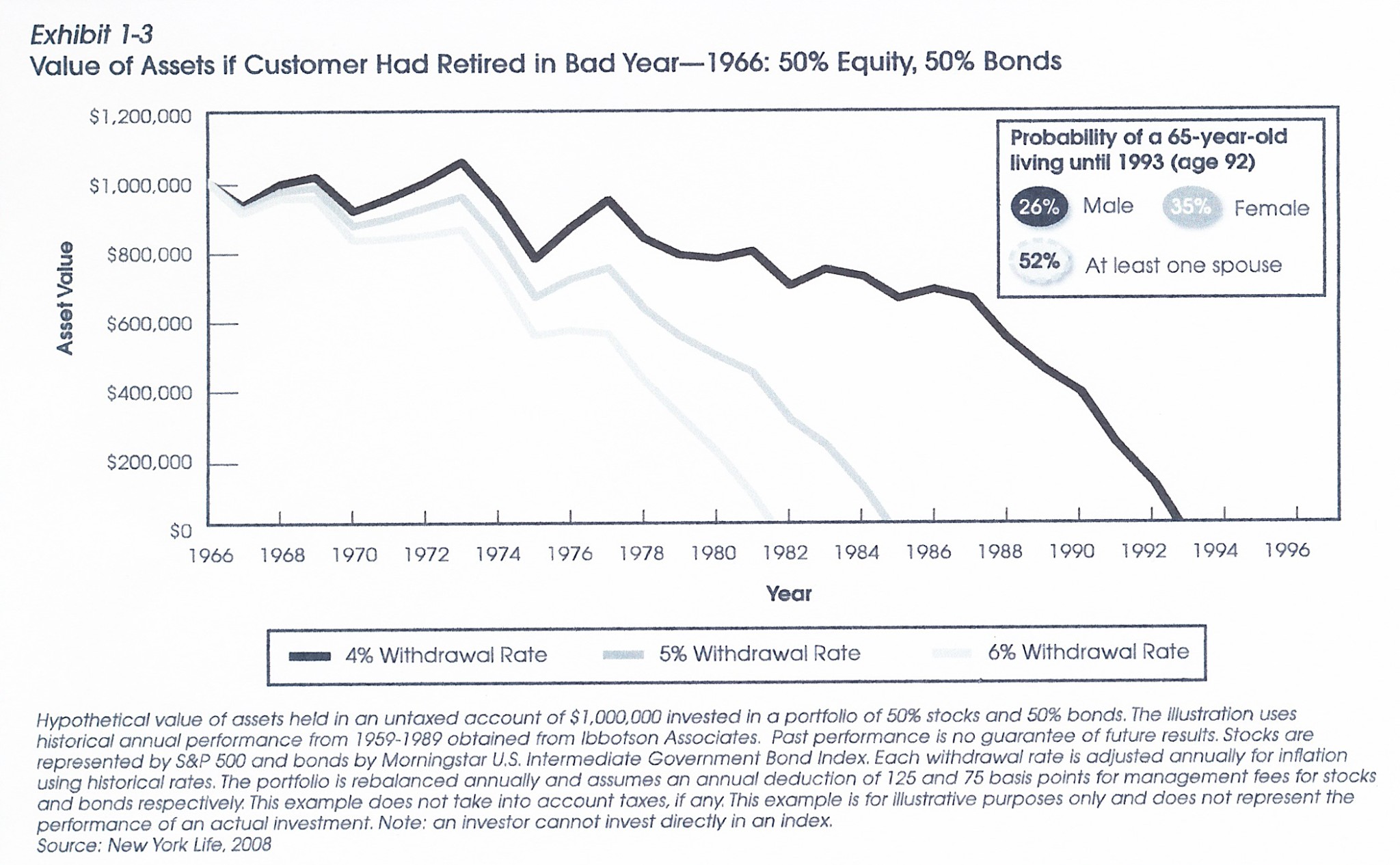

Longevity, deflation and volatility – The combination of these issues could be devastating to a retirement portfolio. (See Exhibits 1-2 and 1-3)

This is why annuities should be considered by many. If you have a withdrawal rate of over 3%, you bring in a higher and higher probability that your portfolio can significantly decrease or run out of money altogether.

- The higher the withdrawal rate, the higher the probability of the portfolio diminishing or being depleted.

- The longer we live, the higher the probability that your portfolio will diminish or deplete.

All of these factors coupled together can create the perfect storm for some during retirement. That is why contracts that provide a guaranteed income for life should be considered. These products coordinated into an overall retirement and investment plan, may afford you the potential for security and peace of mind.

Guarantees are subject to the claims paying ability of the issuing insurance company. Any opinions expressed in this forum are not the opinion or view of American Portfolios Financial Services, Inc. (APFS) or American Portfolios Advisors, Inc.(APA) and have not been reviewed by the firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.

Michael Fliegelman, CLU, ChFC, AEP, CLTC, RFC

Founder / President, Strategic Wealth Advisors Network

(631) 262-9254

Connect with me ![]()

![]()

Follow me on ![]()

![]()

![]()

Michael@SWANWealth.com

www.SWANWealth.com

Please note that the information being provided is strictly as a courtesy. Always confer with your CPA prior to attempting to take any tax deduction. Michael Fliegelman is not a CPA, nor should the contained be considered tax “advice”.

Leave A Comment