{3 minutes to read} Today, we’re going to focus on an estate planning concept called an Intentionally Defective Grantor Trust. This strange name for a trust, sometimes also known as an Intentionally Defective Irrevocable Trust, is a very strong tax shelter for people.

When we are dealing with estate planning, a lot of the focus is on transferring wealth to the next generation tax-free. The government gives us an amount of money that we could give away every year during our lifetime. Currently, that amount is approximately $11 million, which can be given away per person. So, if I’m married, that allows me up to about $23 million to give away. As the Trump tax law for estate planning sunsets on December 31st, 2025, and tax laws change, that amount may be reduced in the future.

What does an Intentionally Defective Trust do? Well, for instance, let’s say I want to give away $5 million estate-tax-free to my kids. I can make this gift, which is below the exemption amount that I mentioned above, and that money will then grow, let’s say in some investments. And let’s assume those investments will grow at 7.2%. In 10 years, that $5 million will have grown to $10 million. In 20 years, it would have grown to $20 million.

Now, let’s say that the $5 million was invested at 7.2% and it generated taxable income. Here’s where the Intentionally Defective Grantor Trust is such a good tax shelter. The Trust is not going to be required to pay the tax. The tax gets paid by the Grantor in his estate, allowing the money that is outside the estate (in the trust) to grow without being encumbered by income taxes. Inside the estate where the estate tax increases by every dollar grown, we are going to lower the taxable estate by paying the income taxes in the estate. The 1099 from the investment income held in the trust goes to the Grantor’s Social Security number, so not only do I get that $5 million out of the estate growing without taxes but the tax that’s created for that is paid in the estate. So, I have more for my heirs, kids, and beneficiaries, and less for the Internal Revenue Service since the income tax is being paid in the estate.

Some believe this is one of the biggest tax shelters still available in the estate planning world. I don’t believe there are too many things that are better from a gift tax and estate planning perspective than utilizing an Intentionally Defective Grantor Trust.

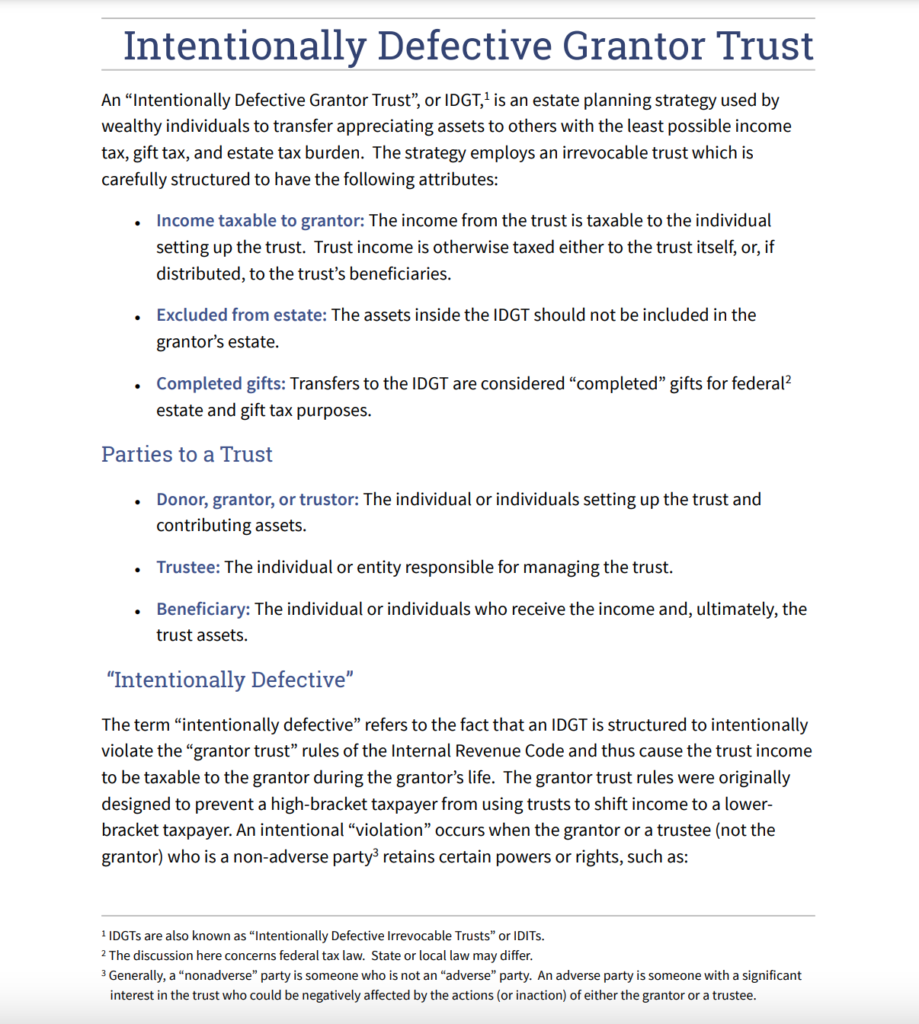

If you’d like to learn more about this, I’ve included a link to a piece that explains it. I would also encourage you to give us a call, so we can discuss it with you and share how an Intentionally Defective Trust might have some benefits for you and your family’s estate plan.

Intentionally Defective Grantor Trust

Thank you very much. Stay safe and be healthy.

Registered Representative offering Securities through American Portfolios Financial Services, Inc. (APFS) Member FINRA/SIPC. Investment Advisory Services are offered through G&G Planning Concepts, Inc. which is not affiliated with APFS. Strategic Wealth Advisors Network and Gassman Financial Group are not affiliated with APFS.

Any opinions expressed in this forum are not the opinion or view of American Portfolios Financial Services, Inc. (APFS) or American Portfolios Advisors, Inc.(APA) and have not been reviewed by the firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.

This material is for informational purposes only. Neither APFS nor its Representatives provide tax, legal or accounting advice. Please consult your own tax, legal or accounting professional before making any decisions.American Portfolios Financial Services, Inc.(APFS) and American Portfolios Advisors, Inc.(APA) are not affiliated with any other named business entities mentioned.

Michael Fliegelman, CLU, ChFC, AEP, CLTC, RFC

Founder / President, Strategic Wealth Advisors Network

(631) 262-9254

Connect with me ![]()

![]()

Follow me on ![]()

![]()

![]()

Michael@SWANWealth.com

www.SWANWealth.com

Please note that the information being provided is strictly as a courtesy. Always confer with your CPA prior to attempting to take any tax deduction. Michael Fliegelman is not a CPA, nor should the contained be considered tax “advice”.

Leave A Comment