{3 minutes to read} Today, I want to talk about Whole Life as a Business Asset.

Many times business owners are seeking ways to protect their businesses against the loss of a key person, or to indemnify their company in the event of a key person or owner dying or becoming disabled. They also can use this insurance to fund their buy-sell agreement or help provide retirement income for that business owner.

However, these same business owners are sometimes faced with the challenge of maintaining a positive balance sheet. When buying life insurance normally there is a premium that’s paid and in the early years, very little to nothing in cash value. That’s very common with term life insurance; with universal life insurance, very little cash value if any is available in the first few years. Most whole life insurance policies also have very low cash values in the early years.

We have a very unique product called High Early Cash Value. This is a policy where, for instance, if you paid a $10,000 premium in year one, the cash value will be approximately 90-95% of the premium, on a guaranteed basis. So, in the context of the business owner who needs to keep his balance sheet looking as good as possible, this product could be a very good option. The payment of the premium takes money out, let’s say, of their bank account, but moves that money into another pocket — a corporate-owned life insurance policy, sometimes referred to as COLI.

The cash value plus the remaining bank account value keeps the client in almost the exact same position from a balance sheet perspective. They can continue to do business with their banks and insurance companies, etc, showing a very positive balance sheet.

This product, however, is not limited just to business owners. It can be purchased by individuals who are looking to buy life insurance but need access to the premiums that they’re paying for this policy. They’ll be able to basically recover virtually all the costs of the policy in the early years.

As you can see from the examples attached to this blog, the cash values are readily accessible, which could be very helpful in many situations, whether you are someone who is looking to buy life insurance for a short period of time, let’s say five or 10 years, and then drop it or have the option to drop it. You would be able to cash it in and get basically all your money back. It’s a good alternative to term life insurance. And it’s great for people who own businesses that need life insurance for buy-sell planning, key-man insurance, deferred compensation, etc.

If you have any questions or want to learn more about this unique life insurance product — High Early Cash Value — give us a call. We’ll be happy to discuss it with you.

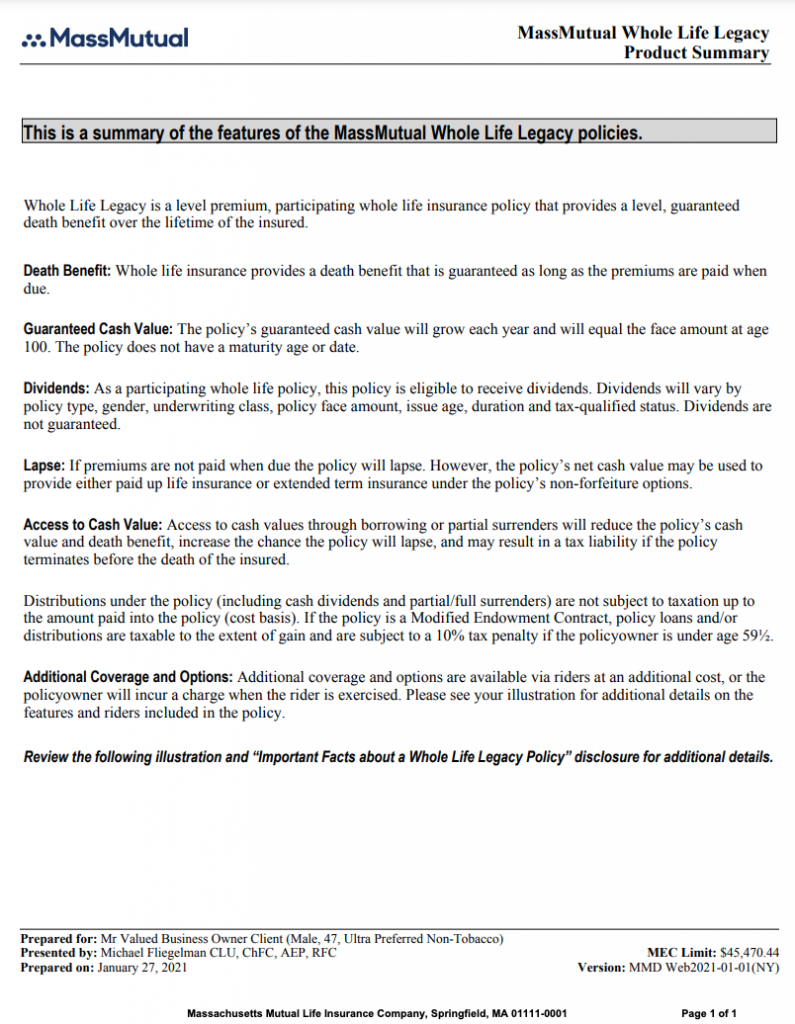

High Early Cash Value – click here or the below image to open the full document.

Registered Representative offering Securities through American Portfolios Financial Services, Inc. (APFS) Member FINRA/SIPC. Investment Advisory Services are offered through G&G Planning Concepts, Inc. which is not affiliated with APFS. Strategic Wealth Advisors Network and Gassman Financial Group are not affiliated with APFS.

Any opinions expressed in this forum are not the opinion or view of American Portfolios Financial Services, Inc. (APFS) or American Portfolios Advisors, Inc.(APA) and have not been reviewed by the firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.

This material is for informational purposes only. Neither APFS nor its Representatives provide tax, legal or accounting advice. Please consult your own tax, legal or accounting professional before making any decisions.American Portfolios Financial Services, Inc.(APFS) and American Portfolios Advisors, Inc.(APA) are not affiliated with any other named business entities mentioned. The decision to purchase life insurance should be based on long-term financial goals and the need for a death benefit. Life insurance is not an appropriate vehicle for short-term savings or short-term investment strategies.

Michael Fliegelman, CLU, ChFC, AEP, CLTC, RFC

Founder / President, Strategic Wealth Advisors Network

(631) 262-9254

Connect with me ![]()

![]()

Follow me on ![]()

![]()

![]()

Michael@SWANWealth.com

www.SWANWealth.com

Please note that the information being provided is strictly as a courtesy. Always confer with your CPA prior to attempting to take any tax deduction. Michael Fliegelman is not a CPA, nor should the contained be considered tax “advice”.

Leave A Comment