{12 minutes to read}

Michael Fliegelman:

We are back again for Part 2 of our discussion about Roth conversions and how to offset the income tax generated by that conversion. We are here with Mr. Brad Gornto, who can help in this kind of charitable planning. And Brad, in Part 1 of our discussion, you walked through the concept that you developed called the iCLAT, for our readers, which is the reversionary charitable lead annuity trust that is designed to offset income taxes in a year where a client might have a spike in their income from a Roth conversion, some liquidity event or come into some money, and want to offset and neutralize that resulting income tax.

Also in Part 1, you prepared a hypothetical illustration for a sample client named Peter. Could you now walk our readers through that illustration and explain the nuts and bolts of how this program would work?

Brad Gornto:

Absolutely. I look forward to doing so, Michael. And the example that we’re going to talk about with Peter is a real example*, except the names, have been changed. This is a very common and ideal iCLAT client situation. This is a very common fact pattern that we see here.

I was approached by Peter through his financial planner, his CPA. They’d already done a million-dollar Roth conversion on his traditional IRA. They already understood the benefits of what they were doing, and I wasn’t a part of that decision. I was brought into it, as you indicated earlier, to help mitigate the taxes from that smart financial planning decision.

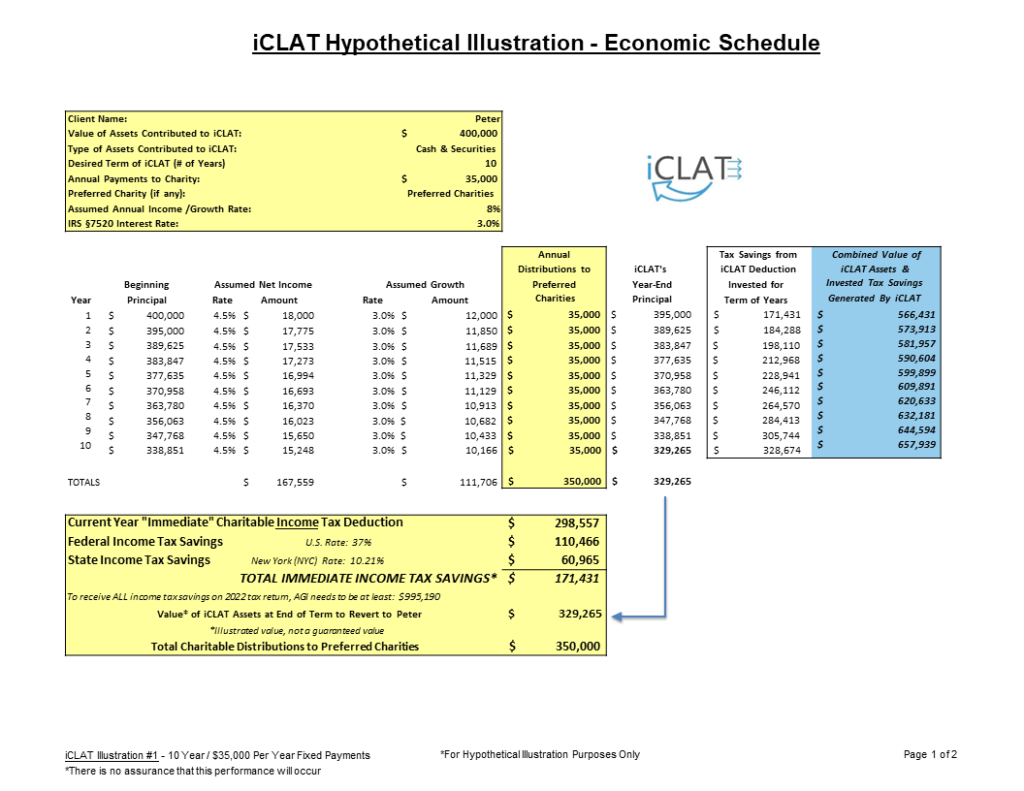

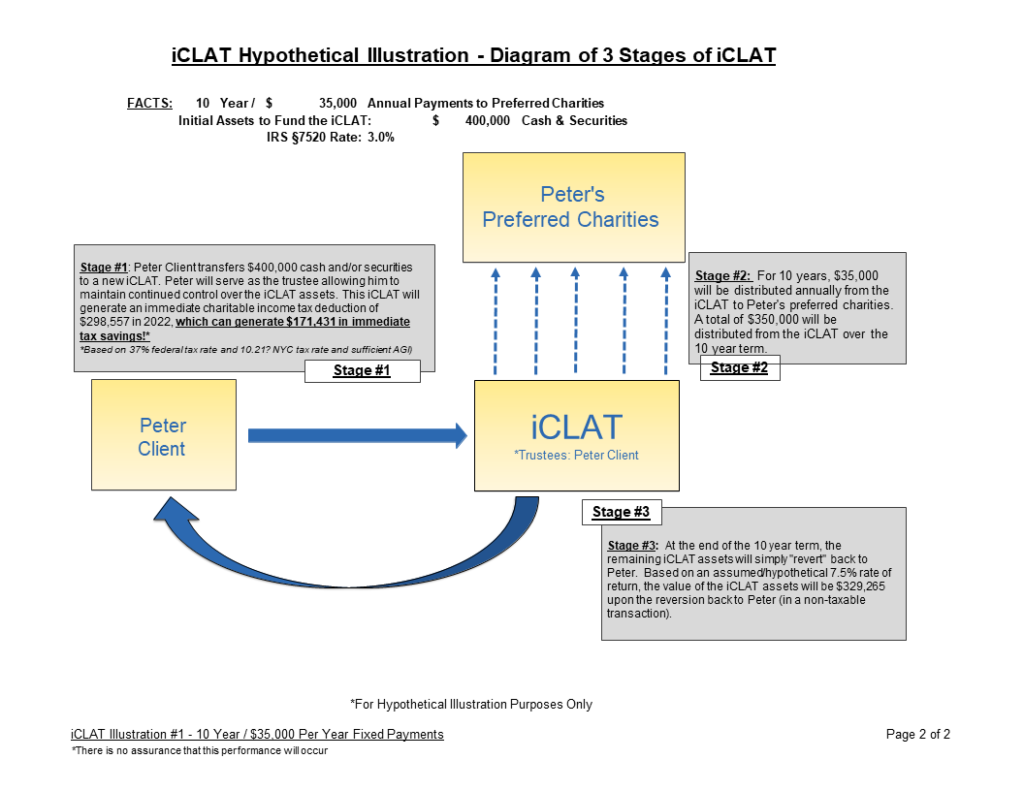

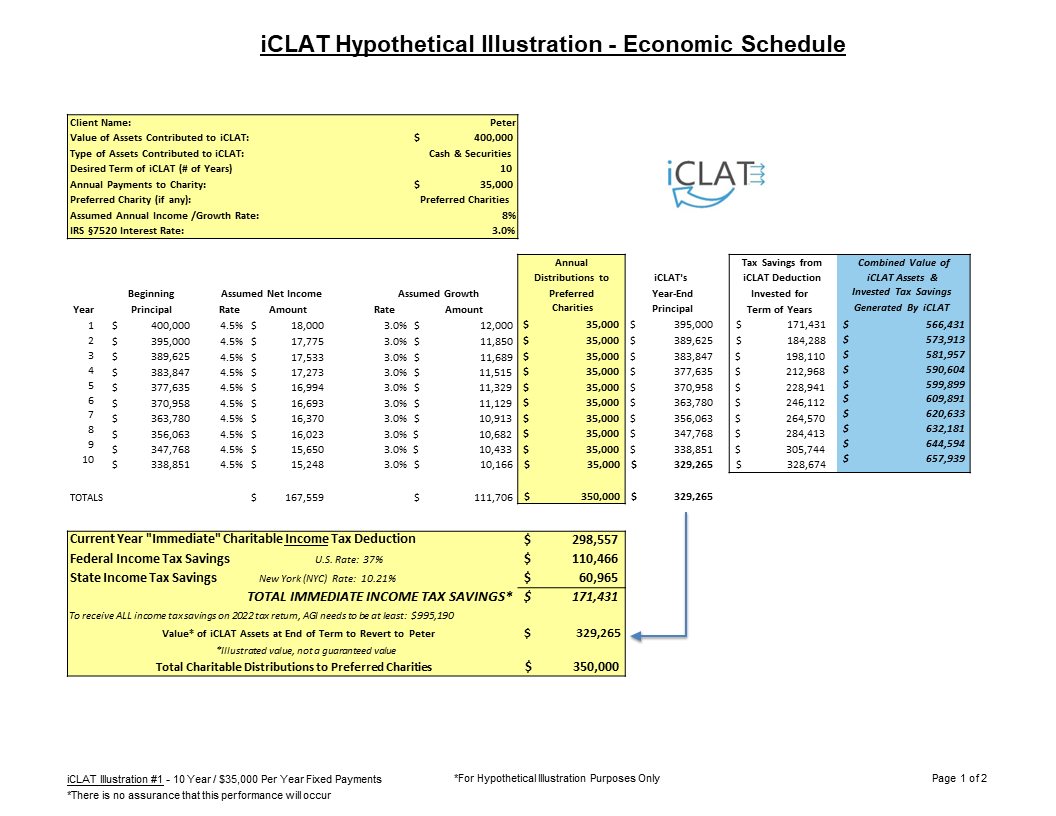

The facts about Peter: he usually gave $35,000 a year, plus or minus to charity. It was part of their normal annual giving and that’s the key aspect. Peter was around 55 and a resident of New York City. We built a 10-year iCLAT for him and will illustrate the numbers for you in some charts later. Basically, all we did was allow him to generate a $298,000 deduction this year by simply setting up an iCLAT in which he makes his typical annual payments of $35,000 a year to charity. (The numbers changed because we’re using the new interest rate.)

All that was involved was Peter simply moving some assets from his current account with his wealth manager to a new account owned by his iCLAT, of which he’s the trustee. He invested as he typically invests, and the only thing coming out of that iCLAT each year is his annual payment to charity. So, that’s where we came up with $35,000. We wanted to build it around what he was already doing.

We are now in the second year of that iCLAT but those assets are growing. Of course, the market fluctuates, but the idea is those assets are going to go up and down in value during the next 10 years, but whatever is in the iCLAT at the end of the 10 years, whether that’s $400,000, $200,000 or $4 million, is going to revert back to Peter in a non-taxable transaction.

That’s the example that we’ve included with this article. That type of deduction for Peter, a New York resident, saved him approximately $110,000 in federal income taxes and almost $61,000 in New York State income taxes for those who live in the city. So, it saved him a total of $171,000 this year to mitigate the decision that he made to convert his IRA to a Roth. And that’s what we accomplished in a couple of weeks. It’s a tax mitigation tool that works very well for folks that are already giving annually, as Peter’s situation reflected. *

Michael:

Brad, that’s a great explanation. And your work with this iCLAT tool is unique in the sense that throughout my career, the utilization of a charitable lead trust has usually been in the context of very wealthy people’s estate plans. In these situations, because the money reverts at the end of the period back to the client, they keep control over that money to some extent. They can be the trustee and they get their money back. But could you talk briefly about a fact pattern where they wouldn’t want the money at the end of the period to come back to them and how these charitable lead trusts could be utilized not only for income tax purposes but also to avoid estate tax as well?

Brad:

Absolutely. And you’ve aptly described the bifurcation. What we always do is design this around what the client’s goals are. Income tax affects more people than estate taxes so we always start with that. To your point, we can get the best of both worlds. We can get the income tax deduction in year one, and we can also get it out of their estate for estate tax purposes. The only substantive change is at the end of the term. In our example, the term for Peter is 10 years, and the assets could go outright to kids or a spouse or a significant other. Typically, they go into a continuing trust for those loved ones and that can be done as well. The rub with that is if you want it out of your estate, you have got to release a little more control. It’s actually just a little, but it’s significant.

It’s a little more restrictive as far as it’s a little different than the way the assets were held before the iCLAT was drafted and funded, but they can still be a trustee. Their wife can be a trustee, but they must give up some other rights, like the ability to change charities. That’s the big thing. And if they are having it go to a private foundation, they must be careful with that as well because the estate tax is a totally different tax, independent of the income tax. You just have more things to look out for, but for our clients that must worry about estate taxes, this can be designed to achieve both and that is often done.

And quite frankly, the history of the tool, and most of them that are out there, do both. So, if I’ve done anything unique it’s that I’ve showcased the simpler variety for the people who do not have to worry about estate taxes, or it’s just not priority one for them at this given time. It’s more of an estate planning objective and it’s just a little bit of a longer engagement if you go that route.

Michael:

Absolutely. Well, this has been very helpful. Brad is available to all our readers to discuss this concept. He’s a very creative estate planning attorney located in Florida, and I urge our readers to contact us or contact Brad if you have any questions.

This is a great tool for not only the ultra-wealthy, like the Jacqueline Kennedy Onassis of the world who use the charitable lead trust for estate planning, but could be for a regular consumer, middle-income person, who’s accumulated a lot of money or may have a spike in income. Charitable lead trusts are an interesting tool and Brad, you did a great job. Thank you so much for your support with our clients and for helping them mitigate and offset the impact of their Roth conversions. And thank you for sharing your knowledge and your wisdom with us regarding this unique tool. Anything else you want to share with our readers?

Brad:

Always a pleasure, Michael, and thank you for those kind words. I alluded to it at the end of the prior article, but the key benefits of this tool will decrease as interest rates rise and that looks like it’s on the horizon. So, if you’re thinking about using this tool or looking at it a little closer, I’d highly recommend that you look at it now versus November/December because of the economy and the situation we’re in right now. Always a pleasure, Michael.

Michael:

Thank you so much, Brad. Really amazing job. You’re a pleasure to work with. Thank you for your support with some of the clients to whom we’ve introduced this. And as Brad is saying, these things are interest rate sensitive so as interest rates go up, the utilization of charitable lead trusts might become less attractive. And that brings up the next type of charitable trust, which we call charitable remainder trust. I think you can confirm this for me — as interest rates go up, those types of charitable trusts might become more popular.

Brad:

There’s no might about it. They do become more popular, but those are testamentary vehicles, whereas this is a lifetime-giving vehicle. But you’re exactly right. There are other tools in the toolbox that will become more attractive for people who want to give assets to charity upon their death.

Michael:

I think that’s extremely helpful and I want to reiterate once again that if anybody has any questions or needs any support setting up any charitable instruments from foundations to charitable lead trusts, to charitable remainder trusts, to donor-advised funds, give me a call or even reach out to Brad directly. His contact information is below, and we thank you for your time, Brad.

And thanks to all the readers out there for reading our blog. Have a great day.

Bradford B. Gornto, Esq., LL.M

Gornto Law, PLLC

310 Wilmette Avenue, Suite 5

Ormond Beach, FL 32174

(386) 257-2554

* There is no assurance your experience will be similar and no assurance of financial success.

Michael Fliegelman, a Registered Representative offering Securities through American Portfolios Financial Services, Inc. (APFS) Member FINRA/SIPC. Investment Advisory Services are offered through G&G Planning Concepts, Inc. which is not affiliated with APFS. Strategic Wealth Advisors Network and Gassman Financial Group are not affiliated with APFS.

Any opinions expressed in this forum are not the opinion or view of American Portfolios Financial Services, Inc. (APFS) or American Portfolios Advisors, Inc.(APA) and have not been reviewed by the firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk, and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.

This material is for informational purposes only. Neither APFS nor its Representatives provide tax, legal, or accounting advice. Please consult your own tax, legal, or accounting professional before making any decisions. American Portfolios Financial Services, Inc.(APFS) and American Portfolios Advisors, Inc.(APA) are not affiliated with any other named business entities mentioned.

To the extent this material concerns tax matters, it is not intended to be used, and cannot be used by a taxpayer for the purposes of avoiding penalties that may be imposed by the law.

Michael Fliegelman, CLU, ChFC, AEP, CLTC, RFC

Founder / President, Strategic Wealth Advisors Network

(631) 262-9254

Connect with me ![]()

![]()

Follow me on ![]()

![]()

![]()

Michael@SWANWealth.com

www.SWANWealth.com

Please note that the information being provided is strictly as a courtesy. Always confer with your CPA prior to attempting to take any tax deduction. Michael Fliegelman is not a CPA, nor should the contained be considered tax “advice”.

Leave A Comment