{5 minutes to read} Is your retirement plan balanced? Many times over my 36-year career, I’ve met people who are approaching retirement. One particular case was a 57-year-old couple approaching retirement, and their predominant assets were their retirement plans and their home. The retirement account, which they have been funding for many years by inputting approximately $40,000 per year, has approximately $2 million in it. Their plan is to slow down or retire at around age 65.

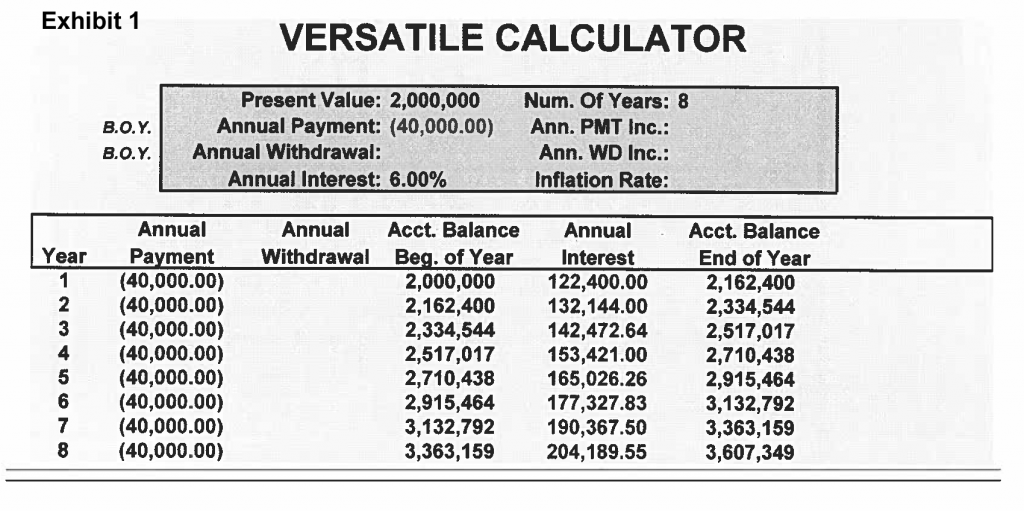

As you can see from Exhibit 1, by taking the $2 million and adding $40,000 per year to it for the next eight years until they’re age 65 (assuming they can earn a hypothetical 6% rate of return), their retirement profit sharing 401(k) plan would have about $3.6 million.

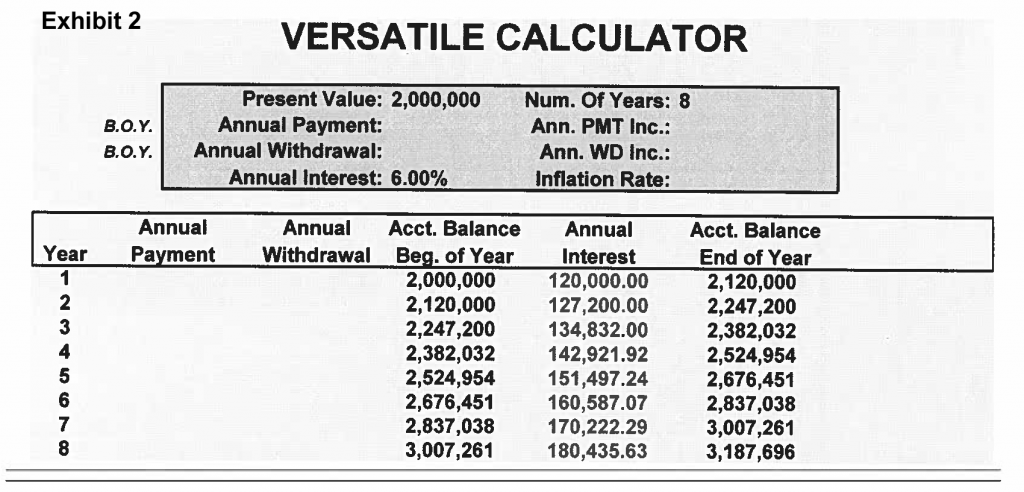

Interestingly enough, as you can see from Exhibit 2, if you don’t contribute the $40,000 for the next eight years (which is $320,000 of contributions), your account value would still grow from $2 million to a hypothetical $3.187 million, which is a growth of a little less than $400,000. The interesting part about this is that the $320,000 in contributions ($40,000 times eight years) only increases the retirement account by a little more than $400,000. So the growth of the account is not the new money — it’s from the old money.

Now, a lot of times people who have these unbalanced retirement plans are driven to put the money into 401(k)s, profit sharing plans, etc. because of habit and they are told about the saving of taxes.

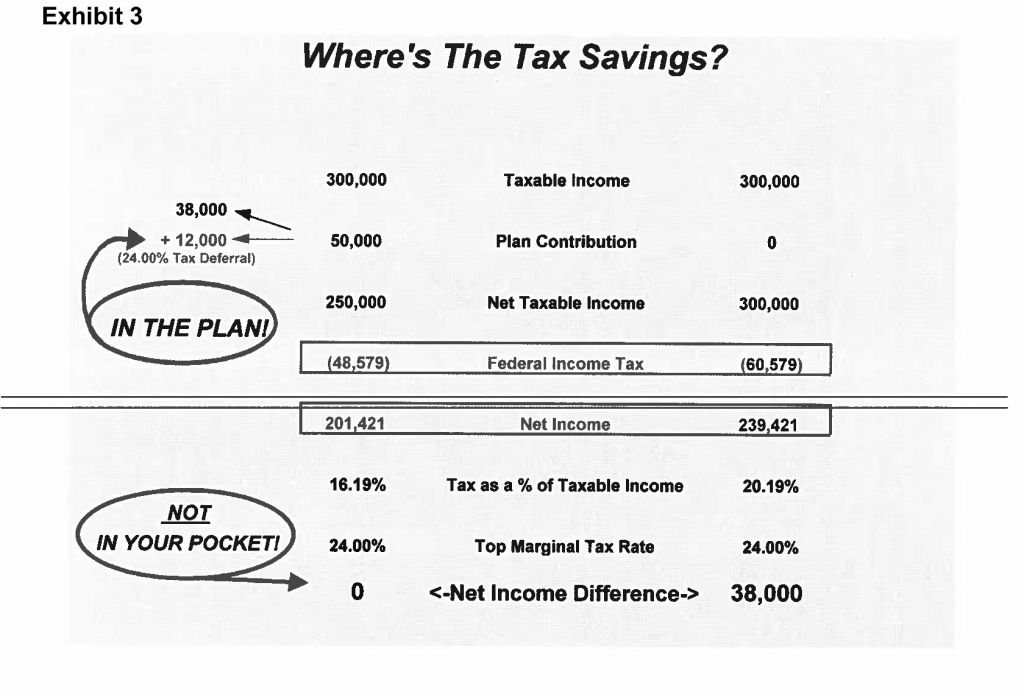

So lets review: One of the primary reasons that a lot of people are putting money into these retirement accounts is that there’s this feeling that you’re saving taxes. Exhibit 3 is a piece that I call “Where’s the tax savings?” and it shows an individual contributing money into a pension plan and the fact that they are going to be in a position where they’re not saving taxes — they’re actually deferring the tax. They’re in a position where if they put $40,000 into a retirement account versus someone who doesn’t put it in a retirement account, they will save approximately $9,600 in taxes.

Those tax savings are not in your pocket; they actually reside inside the plan. Let’s say 10 years from now when this couple retires, tax brackets are higher. They may actually pay more in taxes than they saved by putting the $40,000 in the plan. Also, all distributions coming out of the plan are going to be taxed at the ordinary income tax rate, where if we were saving the money with after tax dollars, we’d afford ourselves the opportunity to either have capital gains tax treatment on the investment income or the retirement income, or if we used insurance planning, we could take money out tax-free.

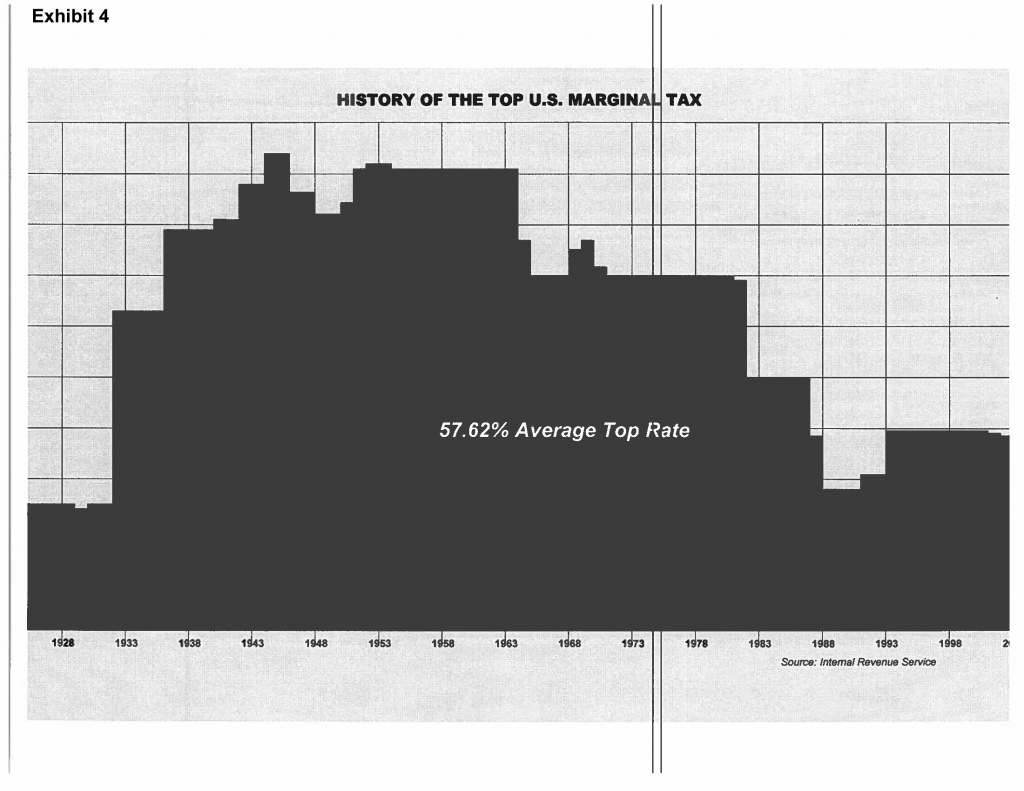

Exhibit 4 shows the history of taxes in our country. The reason that we use this chart is that it illustrates the risk, if your tax bracket goes up in the future. There are no guarantees. What if we deferred our taxes in a 30% or 24% bracket, and in the future, the government changes? A lot of people are worried that if the Democrats get in, taxes will go higher. Well, if that happens, we would have deferred our taxes at 24% but may be taking the taxes out at 30%. So when people have a tremendous amount of money inside a pension plan, it might better serve their interests not to contribute anymore.

This particular client is in a position where he already has $2 million inside his pension. Without any more contributions, it would grow to $3.817 million at a 6% rate of return, giving him the opportunity to take those dollars that would normally be earmarked for the plan and put them into things that are going to be helpful during retirement — capital gains type of investments, stocks, bonds, securities, real estate, life insurance, long-term care insurance — things that are going to be needed to give the client a more balanced retirement.

This information is very important. Too many times we see people with all their retirement savings in 401(k) profit sharing plans and IRAs. If you’d like more information or a personal analysis to see if your plan is out of balance, give us a call, send us your comments, feedback and input. We’re here to help.

Registered Representative offering Securities through American Portfolios Financial Services, Inc. (APFS) Member FINRA/SIPC. Investment Advisory Services are offered through G&G Planning Concepts, Inc. which is not affiliated with APFS. Strategic Wealth Advisors Network and Gassman Financial Group are not affiliated with APFS.

Any opinions expressed in this forum are not the opinion or view of American Portfolios Financial Services, Inc. (APFS) or American Portfolios Advisors, Inc.(APA) and have not been reviewed by the firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.

This material is for informational purposes only. Neither APFS nor its Representatives provide tax, legal or accounting advice. Please consult your own tax, legal or accounting professional before making any decisions. American Portfolios Financial Services, Inc.(APFS) and American Portfolios Advisors, Inc.(APA) are not affiliated with any other named business entities mentioned.

PLEASE NOTE: The information being provided is strictly as a courtesy. When you link to any of the web sites provided here, you are leaving this web site. We make no representation as to the completeness or accuracy of information provided at these web sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, web sites, information and programs made available through this web site. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

The cases are hypothetical examples and there is no assurance your experience will be similar, and no assurance of any financial success

Charts and graphs are courtesy of Leap Systems,LLC 1991-220

Michael Fliegelman, CLU, ChFC, AEP, CLTC, RFC

Founder / President, Strategic Wealth Advisors Network

(631) 262-9254

Connect with me ![]()

![]()

Follow me on ![]()

![]()

![]()

Michael@SWANWealth.com

www.SWANWealth.com

Please note that the information being provided is strictly as a courtesy. Always confer with your CPA prior to attempting to take any tax deduction. Michael Fliegelman is not a CPA, nor should the contained be considered tax “advice”.

Leave A Comment