We help individuals, families, and businesses focus on protection and long-term wealth

strategies leveraging the power of earned income in the early years. Financial decisions made in the early stages tend to have the greatest impact on your financial wealth creation future. We strive to get your money to work harder for you. The services we offer assist you in your personal finance decisions. We offer a full array of financial products and services that, as part of your overall financial strategy, can help you achieve your goals.

- Conservation/Preservation

- Retirement Needs Planning

- College Funding

- Will/Trust Analysis

- Life Insurance

- Long Term Care

Business Services:

- Employee Benefits

- Buy / Sell Strategies

- Succession Planning

- Executive Compensation

- Risk Management Analysis

Investment Services*:

We assist you in the design and implementation of programs to help ensure that your wealth is passed along to family or others, without being negatively impacted by estate or inheritance taxes. This service enables you to plan your personal estate to help ensure maximum distribution and conservation to future generations.

Having the ability to retire comfortably from financial pressures remains the main issue for our clients – both business owners and employees. It is critical that the retirement plan be properly designed, implemented, communicated and administered. Retirement plans are dynamic, changing as client’s businesses and tax laws change. They demand continued and careful analysis, IRS compliance review and plan administration. The appropriateness of a “qualified” or “non-qualified” plan for any individual is determined based on the individual’s existing financial condition, as well as on his or her goals and dreams.

We will work with you to tell you if your current savings strategy may cover your child’s college expenses. Do you dream of your child or grandchild going to college? Higher education comes with a high price tag, but it’s an expense you can help meet through proper financial planning. Let us help you calculate college costs, evaluate funding options and create an education strategy tailored to your goals.

Options may include:

-

- State-sponsored college savings plans (529s)

- Education Savings Accounts

- Traditional and Roth IRAs

- Custodial accounts (UGMA/UTMA)

- Education Trusts

Wills and Trusts are just tools in the larger process of “conservation/preservation.” There is an unfortunate, widespread misconception that this topic is a subject of interest only to the wealthy. In fact, an estate plan provides the legal mechanism for disposing of property upon death in a way that recognizes your wishes and the needs of your survivors, while minimizing taxes. For many it involves, even more importantly, planning for the handling of affairs in case of disability, and the deeply personal medical choices to be made as life nears its end. Conservation/preservation is not just for rich people. Trusts can play an important role in providing order to your financial affairs, assisting with your tax planning, simplifying your estate settlement and providing guidance for your family and other heirs.

Insurance is an important part of a complete financial plan. It helps to protect your heirs in the event of your death, and it may protect you in the event of a disability. We can help you determine what type of coverage is best for you. We can provide access to insurance products, including term life insurance, whole life insurance, universal life insurance, variable life insurance, survivorship, single premium, long-term care strategies* and long-term disability insurance*. As you build relationships and share financial information with us, we are in a unique position to provide guidance and determine which insurance products are best for you.

*Offered through outside carrier

There’s a good chance that you may need to pay for nursing home, assisted living or home health care one day. In fact, more than half of the U.S. population will require long-term care at some point in their lives. Long-term care involves helping you with the most intimate aspects of your life, like what and where you’ll eat and your personal hygiene. Unfortunately, this kind of care is expensive. You probably shouldn’t assume that Uncle Sam will help. Medicare does not cover most long-term care costs. Medicaid benefits are only available to you when you’ve depleted all of your assets. We will help you protect yourself against long-term care expenses with the appropriate coverage.

Providing an employee benefits package that includes quality, affordable health care coverage continues to be one of the greatest challenges for today’s employers. We put our considerable experience in this field to work on delivering alternatives to our clients. We evaluate the design of different benefits packages to achieve the best pricing structure and advice on implementing such options as cafeteria plans that allow for employee cost-sharing through tax deductible contributions. As well, we administer the benefits program, assisting employers with the claims filing procedure.

A Buy-Sell Agreement is simply a written agreement made between the partner or shareholders of the business specifying buy out provisions caused by such things as death, disability, divorce, bankruptcy, voluntary termination, company dissolution, etc. The execution of a Buy-Sell Agreement helps secure a number of very tangible benefits for the shareholders, including:

- Continuity of management and control for the remaining owners

- A ready market for typically non-marketable business interests

- Liquidity to the decedent’s estate for estate taxes and administration costs

- A fair valuation of the business interest for federal estate tax purposes

- A fair return to the decedent’s estate for his/her business interests

A key goal of many of our business owner clients is to someday transfer their business interest to either family members or key employees. Properly done, this type of planning can offer to both the current and successor owner a virtually worry free, tax efficient method of business succession.

Furthermore, the loss of a business owner through death or disability can catch even the most efficiently managed small companies off guard and, worse, unprepared to deal with the repercussions. Family businesses, in particular, are susceptible to erosion of capital due to estate taxes and legal fees; not to mention the possible hurdles of voting control being scattered among heirs, with conflicting points of view impeding the business’ operation and growth.

We can provide a professional evaluation of your current situation that will help avoid future problems involved in business succession planning.

Non-qualified deferred compensation programs, typically employed to provide supplemental retirement benefits to senior management, include selective incentive plans, wherein the company makes contributions to fund the plan on behalf of selected employees. Executive Compensation plans are a popular vehicle to attract and retain key individuals of your company.

Implementing a risk management program is fundamental to a company’s ability to protect itself against the loss of key personnel through death or disabling injury or sickness. We offer expertise on selecting life and disability insurance coverage for such a program.

We conduct a financial security analysis to determine the appropriate protection for companies and their key executives, which encompasses evaluating risk management needs and balancing them with living or wealth accumulation objectives. We design risk management programs to be affordable, to fill corporate and individual needs, and to be flexible enough to allow for a change as needs change. Our analysis also involves a review of any existing coverage to help ensure it is cost effective and includes up-to-date features. Through risk management analysis, we can deliver solutions in the form of policies valued and designed according to our clients’ needs.

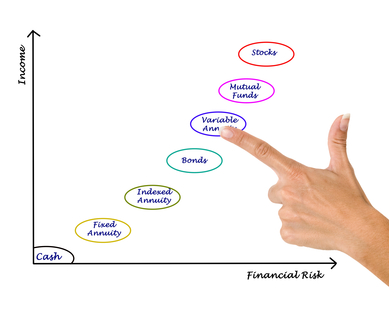

Because every investor is unique, we offer programs that are designed to link your specific investment needs to the appropriate method of professional investment management. We emphasize that each client has unique needs and goals that deserve to be addressed differently. This approach has benefited clients of our firm for many years, and we believe it will remain a successful approach into future decades.

A mutual fund pools money from many investors for the purpose of investing in securities such as stocks, bonds and other assets. The combined holdings of the mutual fund are known as its portfolio. Investors buy shares in a mutual fund, with each share representing an investor’s part ownership in the fund, its holdings and the income it generates (if any). Mutual funds give everyday investors a variety of investment opportunities. Investors in mutual funds benefit from the knowledge and experience of professional investment managers who are dedicated to security analysis, evaluation and selection. Mutual fund shares are redeemable, meaning that investors can sell their shares back to the fund company at the net asset value per share. Mutual Funds are long-term investments subject to market risk so that when shares are redeemed, one’s investment may be worth more or less than the original cost. Since a mutual fund typically holds a variety of investments, buying fund shares can make it easier for investors to diversify than through ownership of individual stocks or bonds. Custody, tax reporting and record keeping are among the many services mutual fund companies provide in a highly cost-effective manner.

Investors should consider the investment objectives, risks, charges, and expenses of a mutual fund carefully before investing. Please carefully read the prospectuses for the relevant mutual funds, which contain this and other information about the products. You can obtain prospectuses from a financial professional.

*The use of diversification and asset allocation as part of an overall investment strategy does not assure a profit or protect against loss in a declining market.

A variable annuity is a personal retirement strategy that can provide you with a solid foundation for your financial future. You may choose among a full range of professionally managed investment portfolios. Your investment return will then fluctuate over time reflecting the performance of the investment portfolios you choose. Your variable annuity investment provides for tax-deferred growth. You don’t pay any current taxes on earnings until they are withdrawn. One of the most unique aspects of a variable annuity is the guarantee you can place on your investments. Variable annuities often provide investment value protection by offering guaranteed death and living benefits. The death benefit guarantees investment amounts for your beneficiaries and living benefits protect investments amounts for you. Additionally, to protect against outliving your income, all variable annuities provide for lifetime income options, which can spread taxation over a lifetime. Withdrawals of taxable amounts are subject to ordinary income tax and if made before age 591Ž2, may be subject to a 10% Federal income tax penalty.

Disclosure: Investors are asked to consider the investment objectives, risks, charges and expenses of the investment carefully before investing. Both the product and the underlying fund prospectuses contain this and other information about the product and underlying investment options. Please read the prospectuses carefully before investing.

© 2003-2013 Leap Systems, LLC – LS012-LS-R1302 – No part of this page may be reproduced, abstracted, excerpted, transmitted, in any form by any means, electronic, mechanical, or photographic, or stored in information systems, except as set forth in writing under a license from Leap Systems, LLC. Any other use is prohibited. Lifetime Economic Acceleration Process™ LEAP®, Leap System® and PS&G Model®, are trademarks of Leap Systems, LLC.